Near the end of 2022, total hedge fund assets under management was below $5 trillion, coming off an industry all-time high of $5.136 trillion earlier that year.

Despite historical trends of growth long-term, it’s been a rough patch for many funds in the last 12-18 months.

Despite the losses, it’s not all bad news:

There will be ups and downs, good days and bad days, and hedge funds will come and go.

And to avoid the fate of those that have fallen, you must learn from others’ mistakes of others.

According to a Capco study, 50% of hedge funds shut down because of operational failures.

Investment issues are the second leading reason for hedge fund closures at 38%.

When breaking down everything that can go wrong, operations makes its case for number one.

Think about everything involved in day-to-day affairs:

Now think of everything that can go wrong:

Bernie Madoff might be the most egregious offender through his multi-billion dollar Ponzi scheme. Proper audits and oversight would have caught criminal behavior like this earlier.

The Bayou Group defrauded investors worth more than $400 million through false accounting and creation of a phony auditing firm.

Wood River Capital Management failed to disclose to the SEC a conflict of interest with its investments. The firm invested 85% of its funds in a company that Wood River’s founder had a stake in, and that company’s stock crashed, wiping out the bulk of WRCM’s assets. Instead of having a more diversified set of investments, in addition to risk-mitigating measures, Wood River misled investors and the SEC.

It’s clear, yet startling, how a hedge fund fail can purely from operations. Even some investment decisions are the results of operational failings, as some of the trades are either unauthorized by the investors or downright illegal.

Fund managers have enough on their plate dealing with investment management; operations management is another beast.

Due diligence being your guide, invest in a strong operations and compliance team, hiring ethical staff who wants what's best for the investors. Assign a chief operating officer and compliance director to ensure monitoring of the day-to-day activities. Document all processes.

When working with third parties, partner with groups that also take compliance seriously, like Empaxis.

Transparent and easily accessible, our outsourcing services for hedge fund operations allow firms to streamline their workflows and cut costs. We are also ISO 22301 compliant.

Firms that trade heavily on margin run a severe risk when the markets head south.

Putting too many of your clients' eggs in one company, industry, or asset class basket is flirting with disaster.

Hedge funds that bet the farm on cryptocurrency, as an example, suffered greatly in 2022. Singapore-based hedge fund Three Arrows Capital was one of them, and the crash ultimately took their firm down. The two founders, Kyle Davies and Su Zhu, then “ghosted” their investors, avoiding those unpleasant conversations.

To avoid trouble, your firm should:

Be upfront about risks and conflicts of interest, even though you might lose investors or receive a smaller share of assets, but your career and reputation are more important than a short-term gain with long-term consequences. Also, never ghost your investors.

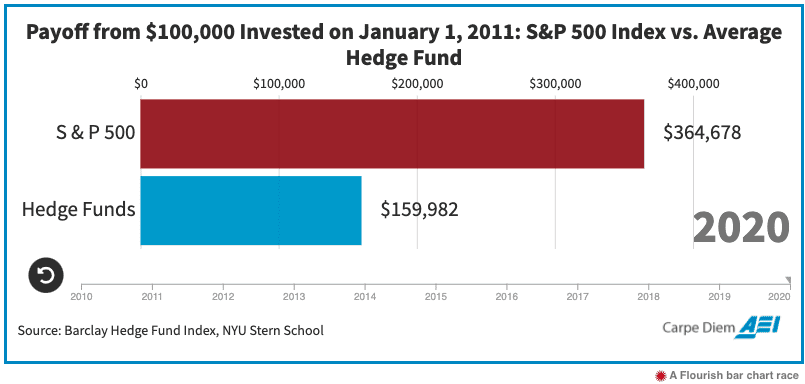

To be sure, there have been some hedge fund winners recently, but the reality is many funds have been unable to outperform traditional benchmarks.

The Global X Guru Index ETF (NYSE:GURU) is a fund that invests in the highest conviction ideas from a select pool of hedge funds. As of April, GURU has underperformed the SPDR S&P 500 (SPY) Trust ETF by 6%.

On top of that, GURU has an expense ratio of 0.75% versus SPY’s 0.09%.

And actually many hedge funds have underperformed the previous decade.

At a certain point, dissatisfied investors will move their assets to better performing managers or go to passively managed index funds.

Spend more time on investment research and leverage tools.

In a survey of the top 50 hedge fund traders, 9 out of 10 plan to use artificial intelligence this year to generate portfolio returns.

And in this inflationary environment with heightened geopolitical tensions and fears of a recession, this is a time to improve your ability to identify trends and opportunities before others see them. Know when to jump on and jump off any “bandwagon.”

If non-investment related work is preventing you from fully focusing, then delegate tasks to competent third parties. This will free up capacity to allow for more time on research, and with this extra capacity, it may be helpful to let your investors know you're outsourcing.

Outsourcing is no longer seen as a "dirty word" among investors, according to Mark Yusko, a hedge fund manager at Morgan Creek Capital Management.

"Many of the things that we as an industry all believed had to be done in-house, on-site, now can be done remote."

- Mark Yusko, Hedge Fund Manager, Morgan Creek Capital Management

While the 2-and-20 model is largely a thing of the past and hedge fund management fee have been falling, investors have less tolerance for underperformance, and fee structures will come under scrutiny.

It may not be a favorable situation for fund managers on the fee front, but this is the reality.

Talented fund managers can make a case to justify their fees, but whatever your structures are, make sure your interests align with the clients'.

Stay focused on performance, and let the performance do the talking when attracting assets. Do well enough consistently, and you’ll command higher fees.

Hedge funds don't have to fail, but they often do because of operational issues.

Competent and ethical individuals, whether in-house or third-party, will do what’s best for their firm and not succumb to the misdeeds of a Bernie Madoff, Bayou Group, or Wood River.

Poor investment choices and excess risk exposure can lead to underperformance like a Three Arrows Capital, thus additional reasons hedge funds fail.

Fund managers need to free up their capacity to focus on research, increasing their investing acumen and foresight. Take advantage of technology to aid in these efforts.

Furthermore, put yourself in the investors' shoes. Are your fees justified? To what extent is your success as a manager determined by the performance of the assets, as opposed to attracting assets to the fund?

All in all, it pays to play by the rules.

Our monthly newsletter features helpful resources, articles, and tips to implement at your investment firm. Enter your email below to subscribe: